No ‘direct’ carbon tax planned for consumers, environment minister says – CBCNews – 12 December 2017

Author by :Jacques Poitras

Photo by : Jacques Poitras

I don’t see how this will satisfy the federal requirements. It doesn’t seem to meet the straight-face test to me. – David Coon

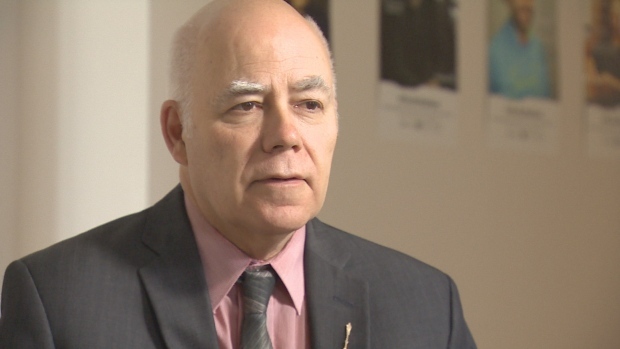

Environment and Local Government Minister Serge Rousselle declined to say whether Ottawa has told New Brunswick whether its carbon plan will satisfy federal standards. (Jacques Poitras/CBC)

New Brunswickers will not pay a “direct” carbon tax under the Liberal government’s planned carbon-pricing system, says Environment and Local Government Minister Serge Rousselle.

Instead, a portion of the existing gas and fuel taxes will be “repurposed” to finance climate change programs, Rousselle told reporters Tuesday morning.

“We are not planning any new direct tax on consumers,” the minister said.

But large industrial emitters in New Brunswick will be subject to a new federal carbon levy that could see them pay more.

Among those large emitters is NB Power, meaning ratepayers could see the Crown utility’s carbon levy passed on to them on their electricity bills.

The federal government is requiring all provinces to implement carbon-pricing systems by next year to create incentives for consumers and industry to reduce carbon-dioxide emissions.

Ottawa says it will impose its regime on any province that refuses to set up its own, and will “top up” any provincial plan that doesn’t meet federal standards.

‘We are confident that this incremental approach … is what is needed for New Brunswick.’ – Serge Rousselle, environment minister

Rather than create its own carbon levy, New Brunswick will step back and let the federal government impose its measures on industry.

Under Ottawa’s system, the emissions of an individual industrial facility — such as an oil refinery or an oil-fired generating station — will be compared to those of its counterparts in the same sector.

The plants that reduce emissions the most won’t pay the levy and will earn credits they can sell to facilities with higher emissions or save for future use.

Other provinces may object

Green Party Leader David Coon said he was surprised by Rousselle’s comments because he said the “repurposed” gas tax probably won’t meet the federal requirement for an economy-wide price on carbon.

“I don’t see how this will satisfy the federal requirements,” Coon said. “It doesn’t seem to meet the straight-face test to me.”

Green Party Leader David Coon isn’t convinced the Gallant government’s carbon plan will meet federal requirements. (CBC)

And he said if Ottawa does approve it, other provinces that have established stricter carbon prices will probably object.

“Other provinces will expect a level playing field across the country, and this certainly doesn’t sound like that,” he said.

He also said the industrial levy system may not set strong enough emission-reduction targets to have any effect.

More details Thursday

Rousselle would not say whether Ottawa has told provincial officials if the blend of a redefined gas tax and the federal industrial levy will satisfy the federal standards.

“We are confident that this incremental approach … is what is needed for New Brunswick, and we are confident this approach is a good one,” Rousselle said.

The federal government requires a carbon price to equal $10 per tonne of carbon dioxide in 2018, rising to $50 per tonne by 2022.

During a second scrum with reporters Tuesday afternoon, Rousselle said the repurposing of the gas tax will “respect the different increases during the next few years,” but he would not say how that would work.

He promised more details on the system when he introduces legislation on Thursday.

‘Taxpayers should have a lot of fear’

The Canadian Taxpayers Federation’s Kevin Lacey believes the province has already reduced emissions enough to meet the 2030 goal. (CBC)

While Coon said the policies don’t go far enough, Kevin Lacey, the Atlantic director of the Canadian Taxpayers Federation, said Tuesday they go too far.

“When the minister talks about ‘repurposing’ taxes, taxpayers should have a lot of fear about these taxes going up,” he said.

Opposition Progressive Conservative Leader Blaine Higgs said the Liberals were repurposing the gas tax now to avoid an unpopular new tax heading into next year’s election.

“This isn’t about anything more than, ‘How do we avoid an upheaval in our province over a carbon tax that turns into an election issue?'” Higgs said.

He said the Liberals are likely planning to increase it if they are re-elected.

Lacey predicts that NB Power will end up passing on the cost of its carbon levy to ratepayers and that the industrial levy on private companies will “trickle down” to affect hiring and hurt the economy.

Lacey would not identify what kind of measure his group would advocate to get emissions down.

He pointed out that the National Energy Board says New Brunswick has already reduced emissions enough to hit the Paris climate agreement’s goal for 2030, a 30 per cent reduction from 2005 emission levels.

But the province says emissions will not continue to decline to the Paris goals for 2050 without additional policy measures.